We understand how important it is to offer competitive salaries and benefits in order to maintain our high level of success. On the flip side, we’re also intent on building a sustainable company that isn’t subject to every fluctuation of the tech industry and the larger economy. Let’s talk through how we handle comp and benefits.

When we find great people, we stand by them. We’re proud to offer reasonable initial salaries and re-address them as people achieve success. The full compensation package we offer is typically competitive, but we know that InterWorks is second to none when it comes to the team you’ll be working with, the atmosphere of casual excellence and the opportunity to do what you genuinely love.

We get paid via direct deposit on the 1st and the 15th of every month. If a payday falls on a Saturday or Sunday, the previous Friday will be our payday.

The standard workweek is from Monday through Sunday, generally consisting of 40 work hours.

Your offer letter shows whether your position is full-time or part-time and whether it’s exempt or non-exempt. Full-time employees are eligible for all benefits, while part-time and temporary employees are only eligible for 401(k) and FlexCare.

In order to determine eligibility for benefits and overtime status and to ensure compliance with federal and state laws and regulations, InterWorks classifies its employees as shown below. InterWorks may review or change employee classifications at any time.

Exempt. Exempt employees are typically paid on a salary basis and are not eligible to receive overtime pay. InterWorks complies with the salary basis requirements of the Fair Labor Standards Act (FLSA). Employees classified as exempt from the overtime pay requirements of the FLSA will be notified of this classification at the time of hire or change in position.

Non-exempt. Non-exempt employees are paid on an hourly basis and are eligible to receive overtime pay for overtime hours worked.

Regular, full-time. Employees who are not in a temporary status, work a minimum of 30 hours weekly and maintain continuous employment status. Generally, these employees are eligible for the full-time benefits package and are subject to the terms, conditions, and limitations of each benefits program.

Regular, part-time. Employees who are not in a temporary status and who are regularly scheduled to work less than 30 hours weekly and who maintain continuous employment status.

Temporary, full-time. Employees who are hired as interim replacements to temporarily supplement the workforce or to assist in the completion of a specific project and who are temporarily scheduled to work InterWorks’ full-time schedule for a limited duration. Employment beyond any initially stated period does not in any way imply a change in employment status.

Temporary, part-time. Employees who are hired as interim replacements to temporarily supplement the workforce or to assist in the completion of a specific project and who are temporarily scheduled to work less than 30 hours weekly for a limited duration. Employment beyond any initially stated period does not in any way imply a change in employment status.

When required due to the needs of the business, employees may be asked to work overtime. Non-exempt employees will be paid overtime compensation at the rate of one and one-half their regular rate of pay for all hours over 40 actually worked in a single workweek. Paid leave, such as holiday, paid time off (PTO), bereavement time, and jury duty, does not apply toward work time. All overtime work must be approved in advance by a manager.

NOTE: There may be state or local laws with different requirements that supersede this general policy.

All non-exempt employees are required to complete accurate weekly time entry in MOAS showing all time actually worked. These records are required by governmental regulations and are used to calculate regular and overtime pay.

Time entry in MOAS does not affect how exempt employees are paid. Rather, it is only used for accounting purposes.

InterWorks’ most important asset is our people, which is why we care about your welfare. That’s also why we offer you an exceptional benefits program with many options, designed to meet your needs and the needs of your family.

We are committed to sponsoring a comprehensive benefits program for all full-time employees. We periodically review the benefits program and will make appropriate modifications based on maintaining a competitive and sustainable level of benefits. Due to the nature of changing and unforeseeable circumstances, we do reserve the right to modify, add or delete benefits offered.

This online kit holds information for all health benefits, including:

This is intended as a convenient summary of the major points of benefit plans. This does not cover all provisions, limitations and exclusions. The official plan documents, policies and certificates of insurance govern in all cases and are available for your inspection at any time.

All employees are entitled to workers’ compensation benefits. This coverage is automatic and immediate and protects you from an on-the-job injury. An on-the-job injury is defined as an accidental injury suffered in the course of your work, or an illness which is directly related to performing your assigned job duties. This job-injury insurance is paid for by InterWorks. If you cannot work due to a job-related injury or illness, workers’ compensation insurance pays your medical bills and provides a portion of your income until you can return to work.

All injuries or illnesses arising out of the scope of your employment must be reported to your manager and Human Resources immediately. Prompt reporting is the key to prompt benefits. Benefits are automatic, but nothing can happen until InterWorks knows about the injury.

The plan is a valuable benefit program offered to you as an employee of InterWorks. It can help you put money aside for a financially secure retirement. Through the plan, you can save for retirement now, so you can have the income you’ll need after you stop working.

Participating in the InterWorks, Inc. 401(k) Plan is easy. You can contribute a portion of your pay to your plan account each payday through convenient payroll deduction. InterWorks also may make contributions to your account. Contributions are then invested in the plan’s investment options you select.

There are tax benefits as well. Your qualifying contributions, employer contributions, and all earnings on your account are not subject to current federal income tax (or, where applicable, state or local taxes) until you take them out of the plan. This tax deferral gives your retirement savings the opportunity to grow under the most favorable terms possible.

Who can participate?

All employees are eligible on the 1st day of the month following the completion of 30 days of service. In addition, you must be age 18 or older.

When may I join?

Once you become eligible, you may enroll on the 1st of the month following the completion of 30 days of service. If you choose to wait, you may enroll at any time using the American Fidelity website.

How much can I contribute to the plan?

As an eligible employee, you may authorize InterWorks to withhold up to 75% of your salary not to exceed the annual dollar limit set by law. InterWorks will not be responsible for any contributions you make over the limit. The annual dollar limit can be found on the IRS website; both traditional pre-tax deferrals and Roth after-tax deferrals are permitted in the plan.

Can I make catch-up contributions to the plan?

Eligible participants who are at least age 50 before the end of the plan year may make catch-up contributions to the plan. The additional catch-up dollar amount can be found at www.irs.gov.

Are rollover contributions permitted to this plan?

Yes, rollover contributions may be made to this plan from other qualified plans and IRAs at any time after you become an employee. Contact your previous employer to initiate the process. You will also need to obtain a rollover packet from the American Funds website.

How does InterWorks contribute to the plan?

Employer Discretionary Contribution: InterWorks will contribute 50% of your contribution up to 6% of your annual salary on your behalf. When InterWorks makes a contribution, it will be subject to a vesting schedule as discussed below.

How do I become “vested” in my plan account?

All contributions that you make are always 100% vested. InterWorks contributions vest as follows:

Years of Service | Percent Vested

After 1 year: 0%

After 2 years: 20%

After 3 years: 40%

After 4 years: 60%

After 5 years: 80%

After 6 years: 100%

What is the normal retirement age for the plan?

The normal retirement age for the plan is age 65. If you are not already fully vested, you will become 100% vested in all of your accounts under the plan if you retire from InterWorks on or after reaching your normal retirement age.

Contact our 3rd party Plan Specialist from Northwestern Mutual with any plan questions or enrollment guidance.

Northwestern Mutual — Liz Zwang

Phone: 1.404.846.3098

elizabeth.zwang@nm.com

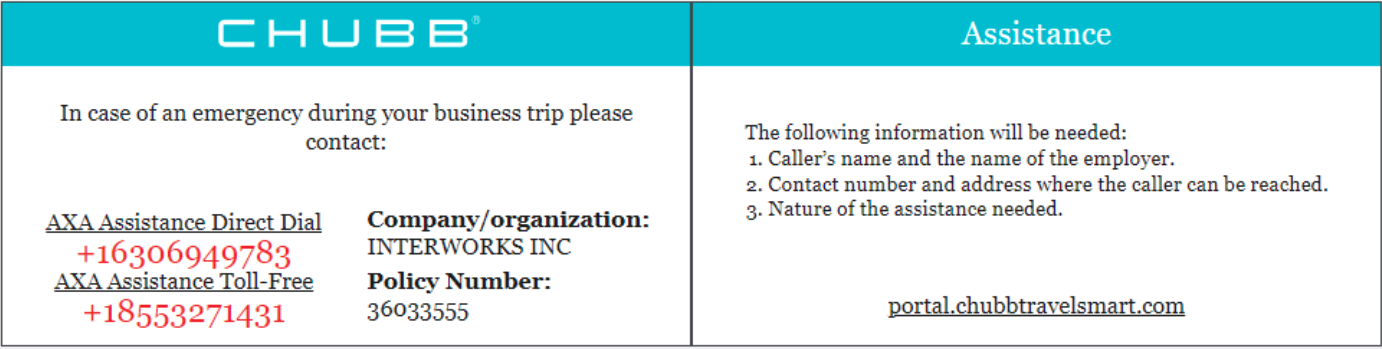

International Travel Assistance services are available to you if you travel on business outside of the United States. The coverage includes:

Medical Assistance and Evacuation Services

Travel Assistance Portal

You can prepare for international travel with a Chub insureds-only website that features information and tools to support you before and during your trips abroad. The site contains real-time destination-based health, security and travel-related information including:

The portal also includes useful tools that help minimize the inconveniences associated with international travel and support you in an emergency such as drug and medical term translation. To register, go to https://portal.chubbtravelsmart.com

Policy number: 36033555

Take a pic of this wallet card to keep with you while traveling for business outside of the U.S.:

We want our regular full-time employees to be healthy, comfortable and efficient while providing the best experience to our clients and co-workers.

To help you create the right environment, we offer a Tech Allowance on each four year interval following your start date. This allowance is typically used for items such as:

Sorry, no software purchases or subscriptions can be paid using this program. Software must be requested and approved through Support.

The Amount

The amount available will be $500 USD or $1000 USD, based on whether you have access to an IW office or if you are full-time remote. In addition, the funds do not expire. Any unused funds at the end of your four-year cycle will be rolled over to the next cycle.

Reimbursement Guidelines

Due to tax reasons that are always fun to try and explain, you must follow the following guidelines to be reimbursed:

The last one may require a little explanation. To keep you from being taxed on this purchase as additional payroll compensation, these items are considered an InterWorks equipment purchase and therefore owned by InterWorks. We will not be able to co-own the items with you, so we cannot partially reimburse. Any item(s) purchased must be fully paid within your allowance amount. Since the items reimbursed by the Tech Allowance are the property of InterWorks, we reserve the right to ask for the items to be returned if you leave us. The cost of any item(s) that you keep if you leave us will be included as a taxable benefit on your final paycheck.

One final note on the three guidelines above: These simply must be followed, or we cannot reimburse. These are not rules that we defined for our own purposes; these are the rules of the various government tax authorities under which we are working. If you have questions about any of the guidelines, please ask before making a purchase.

While there aren’t too many guidelines to follow, they can be a little grey. Here are some examples to help us navigate towards a full reimbursement:

✅ Pat is a full-time remote employee in Salt Lake City with a $1500 spending limit. They are building out a new home office, purchasing three items: a desk ($1000), a chair ($200) and a monitor stand ($200) — all-inclusive of taxes and shipping. They submit the three receipts and are reimbursed.

❌ Martin works in the Tulsa, Oklahoma office and has a $500 spending limit. He purchases a $1200 Louis Vuitton fashion keyboard and submits the receipt believing that he would receive $500 toward the purchase. Unfortunately, the items must be wholly purchased within the allowance limit and his reimbursement is denied.

❌ Bonnie is a full-time remote employee in Atlanta with a $1000 spending limit. She adopts a $350 kitten for her office with the idea that she’ll be happier in the workplace with a cat. While we cannot deny pets are healthy additions to any space, an animal cannot be expensed as a “work-related” purchase under any definition. The reimbursement must be denied.

Remember: If there are any questions about how this works or if you think you may be denied for a purchase, please ask prior to making the purchase. We do not want anyone to be stuck with an unexpected cost.

We support your efforts to stay healthy in body and mind. For some, this is found in regular trips to the gym or studio; while others utilize apps such as Strava or Peloton to keep them active.

To help with these aspirations, InterWorks offers our regular full-time employees reimbursements toward the cost of memberships and subscriptions. Your individual wellness can be closely tied to the wellness of your family and household, so we will also cover family memberships as long as your name is included on the membership or the family member has a membership at the same place as you.

The Amount

Unlimited transactions up to $1200 per year. Upload your receipt in MOAS and be sure your name is shown on the document.

What Is Covered?

Generally speaking, we’re interested in helping with the costs associated with memberships or subscriptions that help you maintain a healthy body and mind. Here are a few to get you thinking about the best path to your personal wellness:

We received a great question recently that offers several answers about the spirit of the benefit:

Would my hiking club be covered? What about my hiking boots? What about our hiking trips/holidays?

✅ Hiking Club? This is a membership – this is covered.

⛔ Hiking Holiday? This is an event – this is not covered.

⛔ Hiking Boots? This is equipment – this is not covered.

Any questions about where these could be used? Feel free to ask in your region’s HR Slack channel.

Reimbursement Guidelines

Similar to our Tech Allowance, this benefit will be made available as a single amount and purchases tracked via a new area within MOAS called Employee Self Service. When you purchase a membership or subscription, simply go to the MOAS page for Wellness and submit your receipt. Make sure your name is listed on the receipt. The reimbursement will be paid out on the 15th of the following month’s paycheck.

Each January 1, the amount will be topped back to the full annual amount — no rollover credits will be applied for Wellness Memberships. Those that start mid-year will have a pro-rated amount made available to them. In the event that you give notice to leave InterWorks, your wellness benefit allowance will be pro-rated to your last day worked. If you have questions related to this point, please contact your HR@ email address.

Keep in mind that this is considered a taxable fringe benefit and subject to tax. The total amount of your actual reimbursements will be reported in the relevant tax year and reported in line with local tax authority requirements. In the US, employees will see their taxed adjustments on their final paycheck in December.

We want our regular full-time employees to relax and recharge, either as a family or going solo. This benefit is usually used for things like an annual membership or pass. Think lakes, parks, golf course, aquatic centers, zoos and museums.

The Amount

Unlimited transactions up to $200 per year. (Renews each year on January 1, no rollover.)

Reimbursement Guidelines

Reimbursement submissions are due by the following day of purchase. Simply go to the Employee Self Service page within MOAS for Life Balance and submit your receipt. Make sure your name is listed on the receipt. The reimbursement will be paid out on the 15th of the following month’s paycheck.

Keep in mind that this is considered a taxable fringe benefit in most regions and subject to tax. The total amount of your actual reimbursements will be reported in the relevant tax year and reported in line with local tax authority requirements. In the US, employees will see their taxed adjustments on their final paycheck in December.

Fringe benefits are taxable in the US as part of income. At InterWorks, this is primarily related to things like gym memberships, wellness benefits, life-balance perks and any tech items that you keep if you leave us.

In order to report these items as income, you’ll see a “TFB” code on your final paycheck in December of each year showing a $0.00 net amount, but listing the amount of these benefits under Earnings, Taxable Benefits-Memberships and deductions.

Professional development is a core part of why many join a consulting company. To help with this goal, InterWorks has a corporate plan which gives access to Udemy content. Please request your personal Udemy access from support@interworks.com.