We understand how important it is to offer competitive salaries and benefits in order to maintain our high level of success. On the flip side, we’re also intent on building a sustainable company that isn’t subject to every fluctuation of the tech industry and the larger economy. Let’s talk through how we handle comp and benefits.

When we find great people, we stand by them. We’re proud to offer reasonable initial salaries and re-address them as people achieve success. The full compensation package we offer is typically competitive, but we know that InterWorks is second to none when it comes to the team you’ll be working with, the atmosphere of casual excellence and the opportunity to do what you genuinely love.

We get paid via direct deposit on the last working day of every month. If a payday falls on a Saturday or Sunday, the previous Friday will be our payday.

The standard workweek is from Monday through Friday, generally consisting of 40 work hours for full time employees.

Time entry in MOAS does not affect how employees are paid. Rather, it is only used for accounting purposes.

InterWorks’ most important asset is our people, which is why we care about your welfare. That’s also why we offer you private health insurance designed to meet your needs and the needs of your family.

InterWorks Europe Ltd employees are automatically placed on the Aviva Solutions plan. You can choose to pay a little more to upgrade your cover and/or arrange separate cover for an additional adult and dependent children up to the age of 21. If you decide to do that, get in touch with UK HR, who will make the necessary arrangements with Aviva for you. Please note that there is a tax implication of about £3 per month for the Aviva plan cover. If you do not wish to be covered, you can opt out.

We periodically review the benefits program and will make appropriate modifications based on maintaining a competitive and sustainable level of benefits. Due to the nature of changing and unforeseeable circumstances, we do reserve the right to modify, add or delete benefits offered.

This section is intended as a convenient summary of the major points of our private health cover and does not cover all provisions, limitations and exclusions. The official plan documents, policies and certificates of insurance govern in all cases and are available for your inspection at any time.

Building up a pension is a vital element of providing for your future. InterWorks will match funding on qualifying earnings into the company pension scheme for UK employees according to the following structure:

For anyone who wishes to raise their employee contribution to 6%, we will raise our match-funding ceiling to 6%, giving the potential for 6%+6% (note: you can increase your employee contribution above this percentage, but the maximum employer contribution will remain at 6%).

On joining, everyone is automatically opted into the pension scheme. You are entitled to opt out, but you must do so in writing and you will be asked every three years if you wish to remain opted out.

This is a band of gross annual earnings (this includes salary, overtime, bonuses and commission, as well as statutory sick, maternity, paternity or adoption pay).

For the 2025/26 tax year the band is £6,240 up to £50, 270 (ie the full band is £44,030). This is the same as the previous tax year.

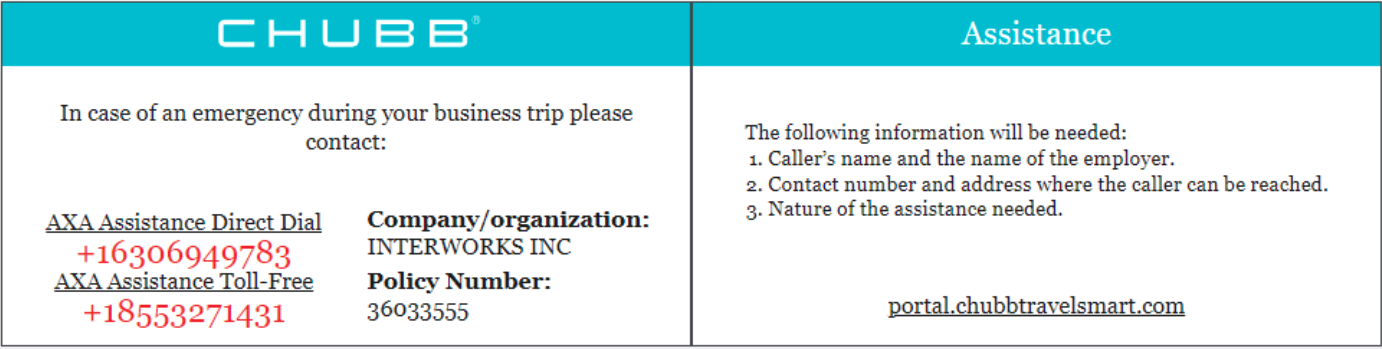

International Travel Assistance services are available to you if you travel on business outside of the United States. The coverage includes:

Medical Assistance and Evacuation Services

Travel Assistance Portal

You can prepare for international travel with a Chub insureds-only website that features information and tools to support you before and during your trips abroad. The site contains real-time destination-based health, security and travel-related information including:

The portal also includes useful tools that help minimize the inconveniences associated with international travel and support you in an emergency such as drug and medical term translation. To register, go to https://portal.chubbtravelsmart.com

Policy number: 36033555

Take a pic of this wallet card to keep with you while traveling for business:

We want our regular full-time employees to be healthy, comfortable and efficient while providing the best experience for our clients and co-workers.

To help you create the right environment, we offer a Tech Allowance on each four-year interval following your start date. This allowance is typically used for items such as:

Sorry, no software purchases or subscriptions can be paid using this programme. Software must be requested and approved through Support.

The amount available will be £420 or £835, based on whether you have access to an IW office or if you are full-time remote. In addition, the funds do not expire. Any unused funds at the end of your four-year cycle will be rolled over to the next cycle.

Due to tax reasons that are always fun to try and explain, you must adhere to the following guidelines to be reimbursed:

The last one may require a little explanation. To keep you from being taxed on this purchase as additional payroll compensation, these items are considered an InterWorks equipment purchase and therefore owned by InterWorks. We will not be able to co-own the items with you, so we cannot partially reimburse. Any item(s) purchased must be fully paid within your allowance amount. Since the items reimbursed by the Tech Allowance are the property of InterWorks, we reserve the right to ask for the items to be returned if you leave us. The cost of any item(s) that you keep if you leave us will be included as a taxable benefit on your final paycheck.

One final note on the three guidelines above: These simply must be followed, or we cannot reimburse. These are not rules that we defined for our own purposes; these are the rules of the various government tax authorities under which we are working. If you have questions about any of the guidelines, please ask before making a purchase.

While there aren’t too many guidelines to follow, they can be a little grey. Here are some examples to help us navigate towards a full reimbursement:

✅ Pat is a full-time remote employee in Manchester with a £835 spending limit. They are building out a new home office, purchasing three items: a desk (£550), a chair £110) and a monitor stand £110) — all-inclusive of taxes and shipping. They submit the three receipts and are reimbursed.

❌ Martin works in the Christchurch office and has a £420 spending limit. He purchases a £950 Louis Vuitton fashion keyboard and submits the receipt believing that he would receive £420toward the purchase. Unfortunately, the items must be wholly purchased within the allowance limit and his reimbursement is denied.

❌ Bonnie is a full-time remote employee in Stoke with a £835spending limit. She adopts a £275 kitten for her office with the idea that she’ll be happier in the workplace with a cat. While we cannot deny pets are healthy additions to any space, an animal cannot be expensed as a “work-related” purchase under any definition. The reimbursement must be denied.

Remember: If there are any questions about how this works or if you think you may be denied for a purchase, please ask prior to making the purchase. We do not want anyone to be stuck with an unexpected cost. Reach out to receipts@interworks.co.uk to check whether you’re covered or not.

We support your efforts to stay healthy in body and mind. For some, this is found in regular trips to the gym or studio; while others utilize apps such as Strava or Peloton to keep them active.

To help with these aspirations, InterWorks offers our regular full-time employees reimbursements toward the cost of memberships and subscriptions. Your individual wellness can be closely tied to the wellness of your family and household, so we will also cover family memberships as long as your name is included on the membership, or the family member has a membership at the same place as you.

Unlimited transactions up to £1,000 per year. Upload your receipt in MOAS and be sure your name is shown on the document.

Generally speaking, we’re interested in helping with the costs associated with memberships or subscriptions that help you maintain a healthy body and mind. Here are a few to get you thinking about the best path to your personal wellness:

We received a great question recently that offers several answers about the spirit of the benefit:

Would my hiking club be covered? What about my hiking boots? What about our hiking trips/holidays?

✅Hiking Club? This is a membership – this is covered.

⛔Hiking Holiday? This is an event – this is not covered.

⛔Hiking Boots? This is equipment – this is not covered.Any questions about where these could be used? Feel free to ask in your region’s HR Slack channel.

Reimbursement Guidelines

Similar to our Tech Allowance, this benefit will be made available as a single amount and purchases tracked via a new area within MOAS called Employee Self Service. When you purchase a membership or subscription, simply go to the MOAS page for Wellness and submit your receipt. Make sure your name is listed on the receipt. The reimbursement will be paid out on the 15th of the following month’s paycheck

Each 1st January, the amount will be topped back to the full annual amount — no rollover credits will be applied for Wellness Memberships. Those that start mid-year will have a pro-rated amount made available to them. In the event that you give notice to leave InterWorks, your wellness benefit allowance will be pro-rated to your last day worked. Any overspend on what you have accrued by the time you leave will be deducted from your final payslip. If you have questions related to this point, please contact your HR@ email address.

Keep in mind that this is considered a taxable fringe benefit and subject to tax.

Life Balance Benefit

At InterWorks, we believe life is about more than work. That’s why we’ve created the Life Balance Benefit—a way to help our employees take a breather, recharge, and enjoy activities that matter to them. Whether it’s exploring the great outdoors, improving your golf swing, or creating unforgettable moments at the zoo or museum with your family, this benefit is here to support your well-being.

How It Works

You can use this benefit to cover the cost made on your personal credit card of an annual membership or pass for activities like:

- National memberships think National Trust, English Heritage or the German/Dutch equivalent.

- Zoos, museums, and other enriching experiences.

The Details

- Annual Limit: We’ll reimburse up to £140 per year for eligible activities.

- Renewal: Your benefit renews each January 1, but any unused amount won’t roll over to the next year.

- Submissions: You may submit unlimited transactions per year up to your allowance amount.

- Reimbursement Timeline: Reimbursement submissions are due by the day after purchase. Once submitted, we’ll process your claim, and you’ll see the reimbursement added to your paycheck on the 15th of the following month.

Submitting You Reimbursement

- Head to the Employee Self-Service page in MOAS for Life Balance.

- Upload your receipt—make sure your name is clearly visible on it.

- Submit your claim and relax while we handle the rest.

Tax Considerations

Keep in mind that this is considered a Taxable Fringe Benefit and subject to tax. The total amount of your actual reimbursements will be reported in the relevant tax year and reported in line with regional Government requirements. If you have any questions on how Fringe Benefits tax is handled in your region, please reach out to Accounting@.

At InterWorks, we know life is about balance, and we’re excited to support your adventures outside the office. Whether you’re discovering new hobbies or reconnecting with the ones you love, this benefit is designed to help you thrive. If you have any questions, please reach out to hr@.

Cyclescheme

Cyclescheme allows you to purchase a bike and accessories and then repay that amount from your gross salary over 12, 24, or 36 months. If you’re going to cycle to work, it’s a great way to save money on the items you might need to purchase to do that. Cyclescheme is no longer capped at £1,000, so budding commuters can now save on the exact bike, components and accessories they need to cycle to work.

Taxable Benefits

Fringe benefits are taxable in the UK as part of income. At InterWorks, this is primarily related to things like gym memberships, wellness benefits, life-balance perks and any tech items that you keep if you leave us.

Electric Vehicle Salary Sacrifice Benefit

Designed to help you drive a brand-new electric car at a fraction of the cost, the EV Salary Sacrifice Scheme is an opportunity to enjoy savings on a lease car, reduce your environmental impact, and take advantage of an all-inclusive, hassle-free car leasing package.

How the Scheme Works

Lease a brand-new or lightly used electric vehicle through Octopus Electric Vehicles with monthly auto deductions from your gross salary, reducing your taxable income. This means you’ll pay less in income tax and National Insurance, making the cost of your EV significantly lower than leasing privately.

What’s Included

The scheme provides everything you need to hit the road stress-free, including:

- A new or lightly used electric car with £0 deposit.

- Fully comprehensive insurance, servicing, repairs, and MOTs included in the monthly cost.

- Replacement tyres and AA breakdown cover.

- Home smart charger installation and 4,000 free miles of electricity.

- Access to over 600,000 public chargers via the Octopus Electrovers network.

- Discounts on Octopus Energy’s EV-friendly home tariff for even cheaper charging.

Eligibility

- You need to have worked for InterWorks for at least 6 months.

- You live in the UK.

- You agree to the Octopus Driver’s Handbook which can be supplied by Octopus on request.

Tax Implications

The scheme benefits from the UK government’s low Benefit-in-Kind (BIK) rates for electric vehicles, making EVs an extremely tax-efficient choice. The salary you sacrifice for your car is subject to these favorable BIK rates, which will appear on your payslip and P11D form.

Note: The BIK rate is currently fixed at 2% until April 2025. From April 2025, the BIK rate will increase by 1% every year until it hits 7% in 2028. You will have to pay tax on this benefit. However, the saving outweighs this cost.

Please note that any costs incurred in the first six months due to cancelation will have to be covered by you, as InterWorks will not pay during this time. Outside of this, the scheme includes insurance for changes in your life and work circumstances. Reach out to hr@ to discuss your options.

Professional Development

Professional development is a core part of why many join a consulting company. To help with this goal, InterWorks has a corporate plan which gives access to Udemy content. Please request your personal Udemy access from support@interworks.com.